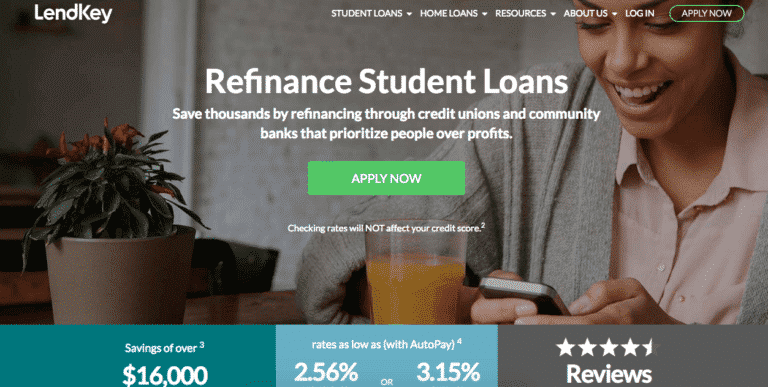

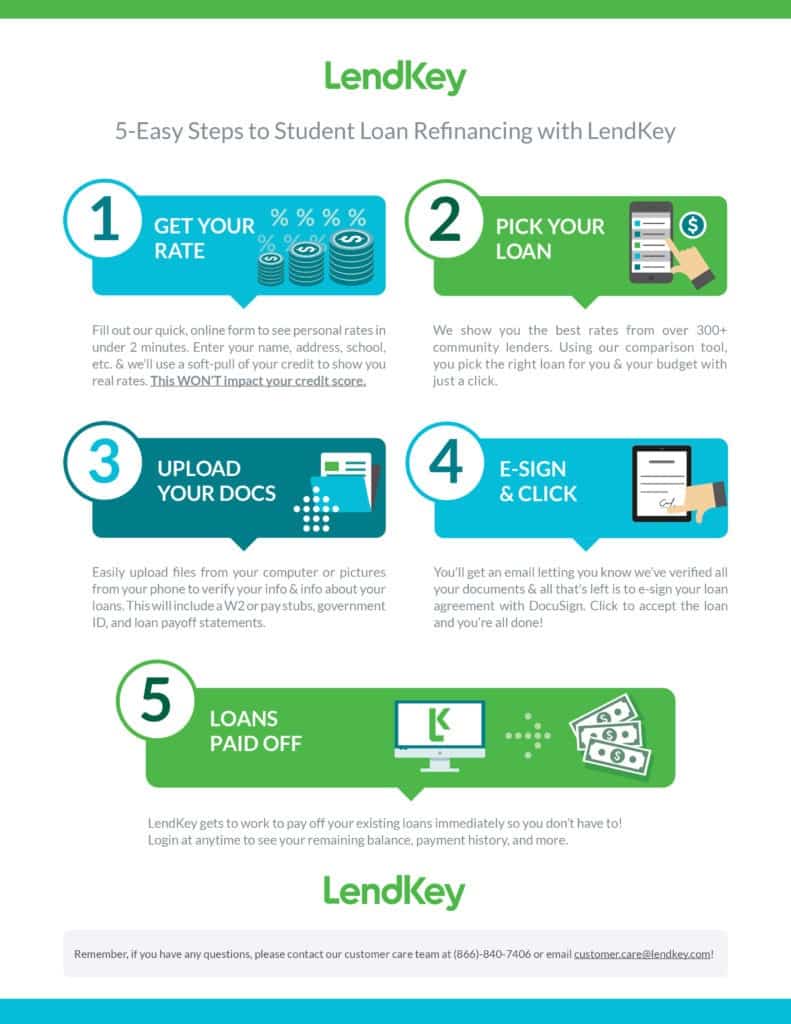

Now in that we know that LendKey is legit, you should know that more than ever, various private lenders are helping student loan borrowers refinance at lower rates and save thousands of dollars in interest — that is, borrowers with good credit.

Before you decide if student loan refinancing is right for you, you should check to see if you would qualify.

Here are some common eligibility requirements: