Want to Make Extra Money Now?

|

Earnest is an online lender offering student loan refinancing with serious benefits. If you are looking for a direct lender who doesn't work with middlemen and gives you a low-rate student loan or student loan refinance (without any fees), you need to check out Earnest.

It takes 2 minutes to find out if you could cut years off your student loan payments. Check to see if you can get a loan through Earnest and if refinancing means a lower rate for you.

NOTICE: Recent legislative changes have suspended all federal student loan payments and waived interest charges on federally held loans until 5/1/22. Please carefully consider these changes before refinancing federally held loans with Earnest, as in doing so you will no longer qualify for these changes or other current or future benefits applicable to federally held loans.

What is Earnest?

Based in San Francisco, CA, Earnest was founded in 2013 and was acquired by Navient, the nation’s largest student loan servicer, in 2017, but still operates under the Earnest brand with its original management.

Earnest is designed to help those who are seeking to cut years off student loan payments with a lower interest rate and/or a lower monthly payment. With over 130,000 clients and $11.6 billion in total student loans refinanced, it's not a bad option for most students who want to refinance.

The company has Better Business Bureau rating of “A+”, the highest rating on their scale ranging from A+ to F.

Let's learn more in our Earnest review.

Earnest Student Loan Refinancing

Earnest is pretty similar to other student loan refinancing lenders however its low rates set it apart. It's also easy to get started:

- See your rate. Simply get an instant interest rate estimate with no impact on your credit score.

- Apply. Fill out a simple application to see if Earnest is the right fit.

- Pay your way. Pick a monthly payment from monthly or bi-weekly options.

You can get your rate by clicking here.

You must be employed to qualify

Earnest is best suited for those who are just coming out of school who have little to no credit history. However, you must have at least a 650 credit score to qualify. It can be seen as a unique way to pay for college since you'll pay less over the life of your loan if your interest rate is currently high.

They have a lot of options for students and other individuals that are looking for a small loan and they have very unique flexibility. For example, you can set your own monthly payments and change between fixed and variable rates without any fees. Earnest has lower than average rates in the industry.

However, you must be employed with regular income, or have a written job offer for a job that will start within six months.

Low interest rates

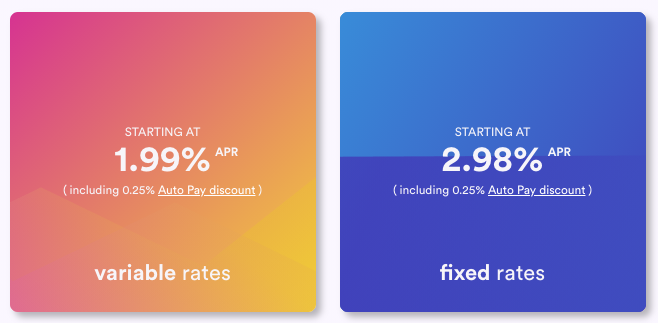

Earnest has interest rates as low as 1.99% for variable APR (including a 0.25% auto pay discount) and starting at 2.98% for fixed APR (including a 0.25% auto pay discount). You can get a loan through them for flexible 5, 7, 10, 15, or 20 year terms. You can get your custom rate in 2 minutes or less by visiting Earnest.

It's simple to qualify as Earnest does not require a minimum income amount or credit score, and borrowers only need $5,000 in student loans to qualify. Earnest currently offers student loan refinancing and consolidation for loans over $5,000.

Pros and Cons

Pros:

- Flexible payment and term based on your budget

- You can skip a payment once every 12 months

- No prepayment penalties, ever

- No late fees or any fees

- High refinance limit up to $500,000

- Low interest rates

- Offers refinancing and consolidation

- Offers auto payment and career support options

Cons:

- No options to apply with a co-signer

- Must have some savings or risk not getting approved

- Need a stable job

- Not available in all states

Earnest Alternatives

Would You Qualify?

Now in 2021, more than ever, various private lenders are helping student loan borrowers refinance at lower rates and save thousands of dollars in interest — that is, borrowers with good credit.

Before you decide if student loan refinancing is right for you, you should check to see if you would qualify.

Here are some common eligibility requirements:

Good credit score

Each lender will have a different credit score requirement, but typically you'll want to have a credit score of 700 or above.

Have a college degree

You should have graduated with an associates’ degree or higher from a Title IV school.

Employed

Most lenders require that you are employed or have sufficient income from other sources, or have an offer of employment to start within the next 90 days.

Good repayment history

You'll want to be current on your bills, credit cards, and other loans, including student loans.

*Once you have determined that refinancing your student loans is right for you, we would recommend reviewing your credit report.

You can get your credit report for free by using AnnualCreditReport.com. If there are any discrepancies on the report, dispute them. This could improve your score and, in turn, improve the terms of the loan.

Why Should You Refinance?

It's simple to check your rate and can save you a lot of money

There are a lot of competing student loan companies and that's good for you. That means you can get the best possible interest rate which can save you a lot of money. The average user saves $18,668 when refinancing. You can check your rate for all of the lenders on this page in under 3 minutes.

If you have a high interest rate on your student loans

Fortunately, for many graduates, refinancing can be a great opportunity to help with loan payments. If you have federal or private student loans with an interest rate over 4%, then refinancing them will save you a lot of money.

Student loans with 6.8% interest rates mean that you'll need to pay $586 a month in interest alone for every $100,000 you owe. You could also refinance your student loans to a longer term to help lower your monthly payments.

If you don't qualify for public student loan forgiveness

Public student loan forgiveness (PSLF) was created in 2007 in order to encourage graduates to pursue full-time work in public sectors including nonprofits and government organizations. If you are working in one of these fields, and have been consistent with your payments, it's best to weigh your options and see if refinancing or PSLF will save you more money over the life on your student loan.

Frequently Asked Questions About Refinancing

What’s the difference between refinancing and consolidation?

Consolidation simply means combining multiple student loans into one loan, but you get different results by consolidating with the federal government vs. consolidating with a private lender. Student loan refinancing is when you apply for a loan under new terms and use that loan to pay off one or more existing student loans.

Would you recommend student loan refinancing?

The biggest benefit of refinancing your student loans is receiving a lower interest rate than your previous student loans carried, which will save you a lot of money over time.

Are my student loans federal or private?

To get a list of your federal student loans, go to the National Student Loan Data Services website maintained by the U.S. Department of Education.

99% of all federal student loans are listed on the National Student Loan Data Services website. If a particular student loan is not listed there, it is most likely a private student loan.

What are the benefits of auto payment?

Set up an automatic direct debit from your checking account to make the monthly payments on your loans. Borrowers with auto-debit are much less likely to miss a payment. Many lenders offer discounts for borrowers who set up auto debit. Federal loans offer a 0.25% interest rate reduction while private student loans often offer a 0.25% or 0.50% interest rate reduction for the remainder of the repayment period. Some lenders will require electronic billing to get the discount.

What company should I refinance my student loans with?

There are hundreds of companies out there that will help you refinance your student loans, but a select few rank above the rest. The five best, are SoFi, Laurel Road, Commonbond, LendKey, and Earnest. All 5 of these companies offer competitive rates with a variety of term lengths, ranging from 5 years to 20 years.

What will my new lower interest rate depend on?

The actual interest rate you will receive is based upon your credit score, income, savings, degree type, and/or presence of a co-signer. To increase your chances of getting approved and receiving the lowest interest rate, it is recommend applying with a co-signer.

Should I be aware of student loan debt relief scams?

Yes. Student Loan Debt Relief Companies and Student Loan Debt Law Firms are very different. Student loan companies are often in the news for scamming student loan borrowers. On the other hand, debt relief attorneys are held to specific ethical and legal standards to act in their clients’ best interest. If they don’t follow these standards, they will be disbarred.

If you are solicited by a student loan debt company – BEWARE! This is a red flag and means they probably obtained your information from a list that they bought. Most of these companies are just out to make a buck and don’t really care about your personal student loan debt struggle.

What should I do if I have Federal and Private student loans?

If you have private and federal loans, SoFi may be your best bet, as they will refinance both loan types together. It is important to apply to several different lenders. Odds are not all of them will offer the same interest rate and terms, so shop around and get the best deal you can find. You can check your rate in under 3 minutes.

What's the best way to pay off student loans?

- Make an overall budget for your monthly income and expenses to include your student loan payments. Make sure you have all payment due dates noted. Use a spreadsheet or an app to help you track where and how you spend your money.

- Set up automatic payments for your student loans, so you don’t miss any. Some lenders often a small discount on your interest rate if you set this up.

- Accelerate repayment of high interest student loans first. You always want to tackle high-interest loans of any kind first.

Earnest vs Other Lenders

- LendKey Refinancing Review

- Laurel Road Refinancing Review

- SoFi Refinancing Review

- CommonBond Refinancing Review

Disclosure: Some of the links above may be affiliate links. Beat Student Loans is helping to transform the $3.2 trillion dollar consumer lending market. By showing consumers real rates from America’s community lenders, we’re ensuring thousands of borrowers are making educated financing choices and putting themselves in the best position to repay their low-interest rate loans.