Want to Make Extra Money Now?

|

Looking for a loan marketplace that covers student loan refinancing and more? Look no further than Credible. One of the standout perks of Credible is that they don't charge any origination fees or application fees on student loans. This means you can save money right from the start. And the best part? Credible offers an easy and lightning-fast online application process. Say goodbye to tedious paperwork and long waiting times.

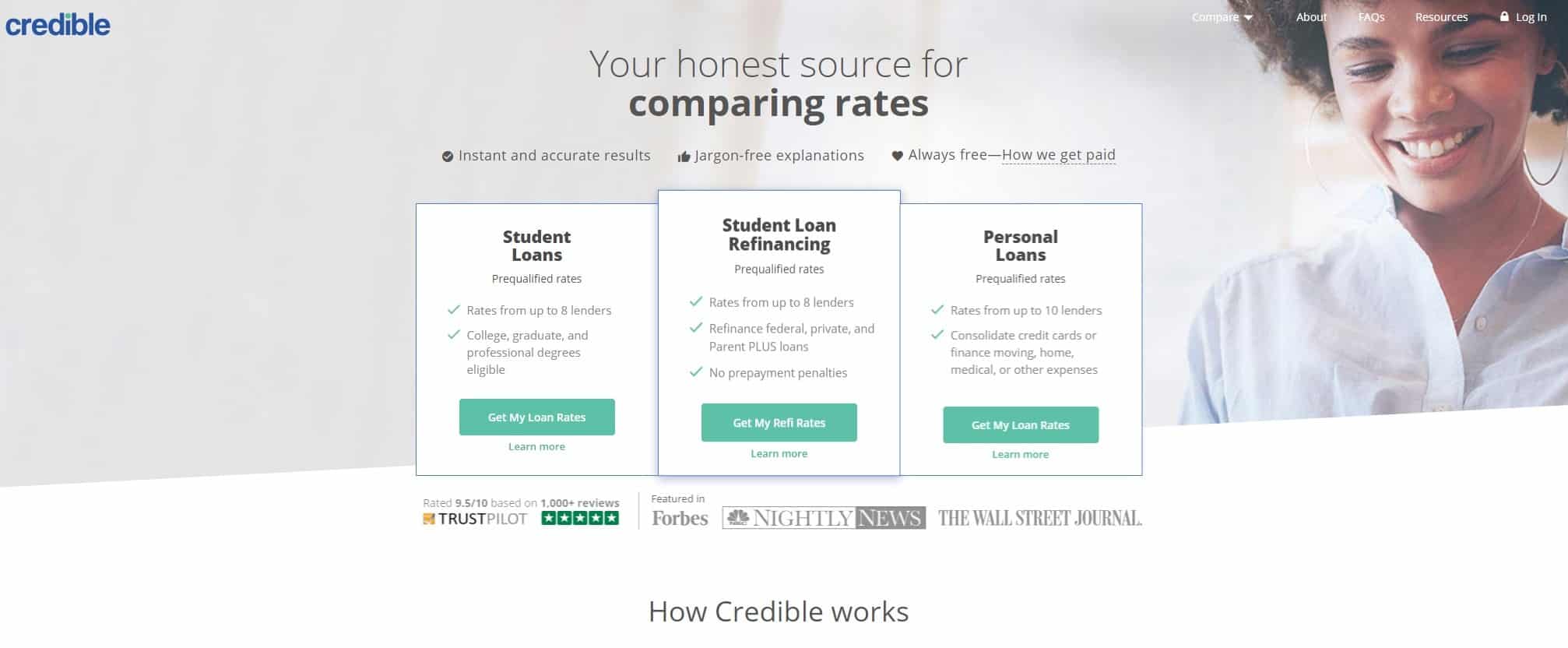

Let me introduce you to Credible! It's an awesome marketplace where you can shop around for student loan refinancing, private student loans, personal loans, mortgages, and credit cards. We've been big fans of Credible for a while because it makes comparing loan options super easy.

If you're looking to snag a better interest rate or lower your student loan payments (especially for private student loans), refinancing is a great option. But finding the best rate and terms can be a real challenge.

There are tons of student loan lenders and refinancing companies out there, and it's hard to know where to start. Plus, you might worry about hurting your credit by applying everywhere. That's where Credible comes in.

Credible consistently tops our list for the best places to refinance student loans and find killer rates. Why? Because they make it a breeze to compare loans and get the best deal quickly.

So, let's dive into our review of Credible and see what it's all about. You'll see why we're so excited about them.

What is Credible?

Credible is the best way to save money on refinancing student loans, private student loans, and personal loans. Easily compare top lenders and find low rates in minutes!

The company works like an online marketplace that provides borrowers with competitive, personalized loan offers from multiple, vetted lenders in real-time.

Credible is a reputable online marketplace that provides consumers with access to various financial products and services. It primarily focuses on facilitating the comparison and selection of student loans, personal loans, mortgages, and credit cards.

On Credible, users can fill out a single application and receive personalized loan offers from multiple lenders. The platform aims to simplify the process of finding and selecting financial products by presenting transparent and competitive options to users. Credible partners with a wide range of lenders and financial institutions to offer consumers a variety of choices.

The website provides tools and resources to help users make informed decisions about their financial needs. It offers features such as loan calculators, educational articles, and customer reviews. Credible aims to promote transparency and ease the financial decision-making process for individuals seeking loans or credit options.

Looking for a loan marketplace that covers student loan refinancing and more? Look no further than Credible. One of the standout perks of Credible is that they don't charge any origination fees or application fees on student loans. This means you can save money right from the start. And the best part? Credible offers an easy and lightning-fast online application process. Say goodbye to tedious paperwork and long waiting times.

Credible Features

Let's talk about the notable features of Credible:

Diverse Loan Options

Credible offers a range of private undergraduate and graduate loans, along with student loan refinancing. Whether you're a student seeking new loans or someone looking to refinance existing loans, Credible has you covered.

Convenient Comparison Tool

One of Credible's main strengths is its comparison feature. Through a single prequalification form, you can easily compare rates and offers from multiple lenders. This saves you time and effort by providing a comprehensive overview of your options in one place. The best part? The prequalification process doesn't require a hard credit pull, meaning it won't have a significant impact on your credit score*.

Speedy Prequalification

Credible prides itself on a quick prequalification process. They claim that you can complete the form in just three minutes. This efficiency allows you to swiftly explore and assess potential loan options without unnecessary delays.

Rate Matching Benefit

Credible goes the extra mile by offering a rate matching benefit. If you happen to find a better rate outside of Credible, they may qualify you for a $200 gift card. This encourages borrowers to actively compare rates and ensures they receive competitive offers.

Credible combines a diverse selection of loans, a convenient comparison tool, efficient prequalification, and an enticing rate matching benefit. With these features, they aim to simplify the loan process and empower borrowers to make informed decisions.

How Credible Student Loan Refinancing Works

Let me walk you through how student loan refinancing works with Credible. It's pretty straightforward:

- Personalized rate estimates: Start by filling out a short form on Credible's website. They'll ask about your education history, finances, and the total amount you want to refinance. You'll also create a Credible account, but don't worry, it won't affect your credit score* with a hard credit check.

- Compare rates and lenders: Once you've provided the necessary information, you'll see a dashboard displaying the refinance rates you're likely to qualify for. You'll find multiple options from each lender, as they offer various term lengths, fixed and variable interest rates. Use the filters to narrow down your choices based on your preferences.

- Choose and apply: Take your time to research and compare your options. The ideal lender will probably offer the lowest interest rate, but don't forget to consider other features that matter to you, like co-signer release. Once you've made your decision, it's time to apply. You'll import your loan information, and the lender will conduct a hard credit check before making you an offer. After this step, the lender will reach out to you to finalize the new loan.

That's it! Credible makes it convenient to explore different refinancing options and find the best fit for your needs.

Enter your info at Credible to find out what your new interest rate could be.

Looking for a loan marketplace that covers student loan refinancing and more? Look no further than Credible. One of the standout perks of Credible is that they don't charge any origination fees or application fees on student loans. This means you can save money right from the start. And the best part? Credible offers an easy and lightning-fast online application process. Say goodbye to tedious paperwork and long waiting times.

When Does Refinancing Student Loans Make Sense?

Refinancing your student loans can be a smart move if you're looking to save money or simplify your loan repayment. Here are a few situations where it makes sense:

- Lower interest rates: If you took out your loans when interest rates were high, but now you have a good credit score and steady income, refinancing can help you snag a lower interest rate. That means you'll pay less in interest over the life of the loan, saving you some hard-earned cash.

- Simplify multiple loans: If you have several student loans with different interest rates and repayment terms, refinancing allows you to consolidate them into a single loan. Managing one loan instead of juggling multiple payments can make your life a lot easier.

- Change loan terms: Refinancing gives you the opportunity to adjust your loan terms. You can opt for a shorter repayment period to pay off your loan faster and save on interest. Alternatively, you can choose a longer term to lower your monthly payments and free up some cash flow.

- Improve financial situation: If your financial circumstances have improved since you first took out your loans, refinancing can help you take advantage of better loan terms. Higher income or an improved credit score can qualify you for better rates and more favorable terms.

Remember, though, refinancing may not be the best choice for everyone. If you have federal loans, refinancing with a private lender means you'll lose out on certain federal benefits like income-driven repayment plans or loan forgiveness options. So, make sure to weigh the pros and cons before making a decision.

Ultimately, refinancing can be a great option to save money, simplify your loans, and customize your repayment. Just be sure to do your research, compare offers, and choose the option that aligns with your financial goals.

Looking for a loan marketplace that covers student loan refinancing and more? Look no further than Credible. One of the standout perks of Credible is that they don't charge any origination fees or application fees on student loans. This means you can save money right from the start. And the best part? Credible offers an easy and lightning-fast online application process. Say goodbye to tedious paperwork and long waiting times.

*Requesting prequalified rates on Credible is free and doesn't affect your credit score. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.