Want to Make Extra Money Now?

|

Research shows that there are 80+ apps installed on the average smartphone. But with that said, people aren't using all of those apps. The average person uses 9 mobile apps per day and 30 apps per month.

Are you using apps to save money?

Whether it’s preparing to buy a big-ticket item, building a nest egg for retirement, or just saving dimes and dollars for paying back student loans, saving money is crucially important.

But it doesn't have to be painful — especially with a powerful personal computer in your pocket disguised as a telephone. Here are 24 apps to help you save money — for today or tomorrow.

24 Best Money Saving Apps

In case you need a new personal finance app in your life, here is a list of the best money savings apps for 2022.

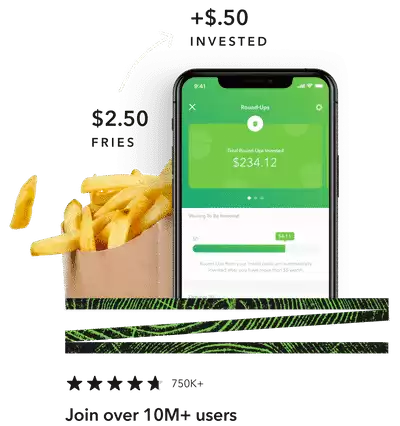

1. Acorns

Acorns offers a mobile and web app. It functions by saving small amounts of money automatically, this time by rounding up your purchases to the nearest dollar on a linked account or card and by investing the difference in your Acorns account. The service recently launched “Acorns Later” — a full-featured retirement account that that's perfect for anybody without an employer-sponsored retirement plan.

Best for

Acorns is best for anybody looking to invest on the cheap. When choosing a savings account, you should consider Acorns. Because your money is being invested, it will be subject to risk from market volatility especially if you choose an aggressive portfolio that invests in stocks heavily.

Price

For just $3 a month, you can open an Acorns investment account and invest without even thinking about it. Use an Acorns sign up bonus to get up to $10 simply for joining.

In under 3 minutes, start investing spare change, saving for retirement, earning more, spending smarter, and more. Invest with as little as $5.

2. Mint

Mint styles itself as your personal finance consigliere. By linking your major financial institutions and ATM cards, Mint delivers a top-down view of your entire financial life. You can build and fine-tune a budget, create an emergency fund, manage your money and look over your credit score — all for free.

Best for

Mint is best for anybody who wants a holistic view of their entire financial life. The app is most powerful for folks with varied accounts and credit cards. It is similar to Personal Capital, allowing you to monitor your net worth.

Price

Mint provides its service at no cost. There are premium services if you need an accountant to check your financials or advice on specific topics, but the basic service is free.

3. Qapital

Qapital is another mobile-focused savings app that makes automatic or manual deposits based on your income. But it goes a step further than some of the others by offering a social and family component, where you can save money as part of a group, as well as robust goal-setting features for when you have specific savings milestones in mind.

Best for

Qapital is best for anybody looking to save on a group level or who wants goal-based savings.

Price

Qapital is free to use with basic services. Upgrading allows for unlimited savings accounts, advanced goal-setting and automation based on triggers like time of day or location.

4. GetUpside

If somebody out there enjoys buying — and overpaying for — gasoline, we’ve never met them. That’s what GetUpside is for. It offers several tools for frugal drivers. First, it’ll show you the lowest gas prices near you. You can also use it to calculate MPG. Or, for long road trips, you can find the best gas prices in advance and add them as stops on your itinerary.

Best for

GetUpside is best for those who want to save money on gas and find the cheapest gas prices in their area.

Price

GetUpside is free to use. It makes money by advertising for gas stations and other products. Additionally, you'll pay a small extra fee if you want to add multiple stops in advance.

5. Digit

Digit is essentially an money-saving and money-making app with a goal of making savings a mindless task for its users. The app is a micro-savings platform that analyzes your spending to determine the perfect amount that you can save over time. Then it makes automatic withdrawals and transfers it to your savings without you even thinking about it.

As Digit’s CEO Ethan Bloch had it, the goal of the app is to make saving as easy, stress-free and automatic as possible even if you’re a broke college student.

Best for

Digit can help people save money without feeling like they're often struggling to remember all of their financial obligations. The Digit savings app has an average 4.7 rating out of 206,937+ reviews on the App Store and a 4.6 rating out of 35,358 votes in the Google Play store.

Price

$5 per month after a 30-day free trial

6. Chime

Chime brands itself as an award winning mobile banking app and debit card. You can set your checking account to commit 10 percent of incoming paychecks to savings automatically. Additionally, some purchases you pay for using your Chime account are eligible for earning cash back.

Best for

Chime is best for those who want a newer way to bank. They offer so many benefits over traditional banks such as fee-free overdrafts up to $200, getting paid 2 days earlier, and letting you grow your savings.*

Price

It charges no monthly account fees and doesn't require a minimum balance.

Chime will spot you up to $200 if you accidentally overdraft. And even better: they won’t charge you a dime.

Chime is a financial technology company, not a bank. Banking services provided by, and debit card issued by, The Bancorp Bank or Stride Bank, N.A.; Members FDIC.

*Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Checking Account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases and cash withdrawals initially, but may be later eligible for a higher limit of up to $200 or more based on member’s Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime’s discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won’t cover non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. See Terms and Condition

^Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

7. Robinhood

In underprepared hands, an investing app is a money-loser rather than a money-saver. Robinhood offers free stock and bond trading and an intuitive interface, so it’s a smart way to play the market while saving the money you’d otherwise lose to commissions.

Best for

Best for those who want to have an easy to use brokerage that lets you buy stocks, ETFs and crypto for free.

Price

Investing with Robinhood is commission-free, now and forever. They don't charge you fees to open your account, to maintain your account, or to transfer funds to your account.

Robinhood offers commission-free stock, ETF and options trades, a streamlined trading platform and free cryptocurrency trading. New users can get a free stock worth up to $225 just for joining.

8. Trim

Trim makes the bold claim that its machine learning-facilitated app platform saves its users one million dollars per month. How? By looking over your finances and canceling unused subscriptions, finding more affordable utility and service providers and generally looking for waste and redundancy. Give it a try.

Best for

Those who want to save money — Trim claims they can save you up to 30% on your bills by finding all of the ways you could be under-billed.

Price

If they reduce the amount you pay (which they do most of the time), they will take up to 33% upfront of your annual savings in one credit card charge.

9. Honey

Honey is a browser extension for Safari, Firefox and Chrome rather than a standalone mobile or web app — but it’s a potential life-saver just the same. After you install it, Honey keeps an eye on the checkout process at major internet retailers and automatically finds current coupon codes to apply to your order.

Best for

You should Honey if you want to stop wasting time and money by having them find coupon codes on 30,000+ sites.

Price

Honey is completely free.

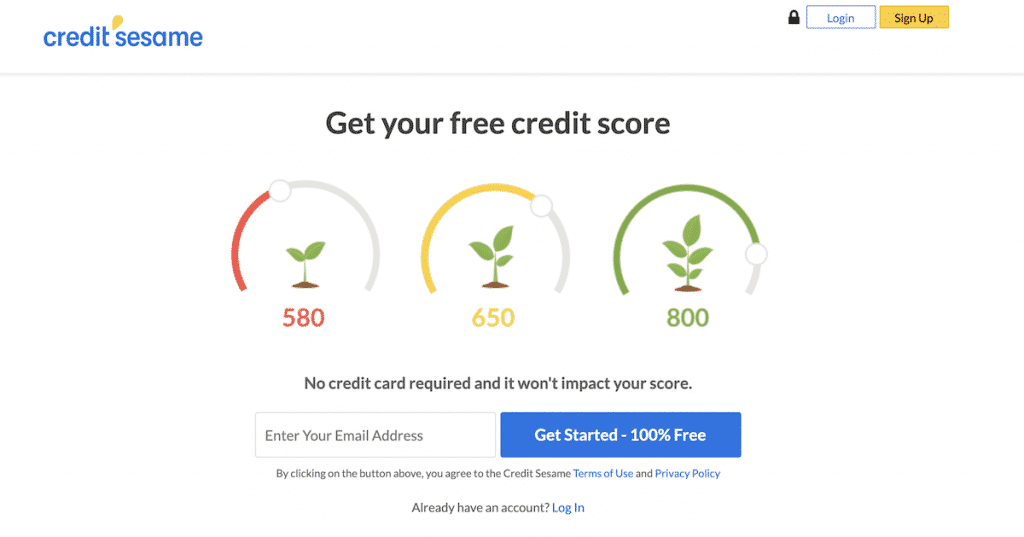

10. Credit Sesame

Sometimes, saving money for the future or a major purchase requires a little personal finance triage first. If that’s the case, the Credit Sesame app is a good starting point for anybody who wants to find out where they stand credit-wise and get some practical tips for improving it, saving money on ordinary expenses while you do so.

Best for

Credit Sesame is good for those who want to see their credit score for free. Although, most credit card providers provide this, but if yours don't, it's a must have.

Price

Credit Sesame is 100% free, no credit card is required and it won't impact your credit score.

11. Ibotta

You can probably file this one under “sounds too good to be true but isn’t.” Ibotta is an app that works with 300 major retailers, including big-box stores, to help you get some money back, retroactively, on purchases you already make regularly. Some users report savings of up to $25 in their first month without changing their shopping habits.

Best for

Those who want a grocery savings app that's been around the block for years. You can get 10 dollars now by signing up and claiming your first offer.

Price

Ibotta is completely free to use.

12. Swagbucks

If you’re looking for a way to browse for cool deals, search for specific items, conduct paid surveys and generally earn a little bit back on all of the shopping research you’d be doing anyway, Swagbucks is for you. After you link a PayPal account, most of your activity on the app — from doing product searches to providing marketing feedback — helps you earn points toward cash rewards.

Best for

Swagbucks Coupons is worth using if you are already using Swagbucks to make extra money on the side. You can make $100 fast a month by using the site and earning through various ways.

Price

Swagbucks is 100% free to use.

If you want another quick way to make money online then give Swagbucks a shot. You'd be silly not too as the site has already paid out $441.9 million to its users.

13. Rakuten

Rakuten functions a little like an outlet store for 2,500 internet retailers. By making Rakuten your “shopping portal,” either through the web app or a browser extension, you have access to thousands of great deals — up to 40 percent off — on almost anything you can imagine, straight from your retailers of choice.

Best for

Rakuten is one of the best money saving apps available for avid online shoppers.

Price

Rakuten is 100% free to use.

15. Poshmark

You can think of the Poshmark app a little like a high-end thrift store. It’s a mobile-first peer-to-peer digital marketplace where people can buy, swap and sell clothing, footwear and fashion accessories by sought-after and luxury brands, sometimes for 70 percent off the “rack price.” For items where counterfeiting is a worry, Poshmark offers authenticity checks for purchases over $500.

Best for

Depending on your spending habits, Poshmark can save you a ton of money on used clothing, fashion, home decor, beauty, and more.

Price

Poshmark is free to use.

Other Money Saving Apps to Consider

These other money saving apps should be considered as well if you like saving money.

16. Checkout 51

Checkout 51 is an excellent tool for anybody who frequently shops for household groceries and other items. Using the app is easy — you create a free account and then upload receipts of purchases you’ve made for qualifying items. Checkout 51 keeps a continually updated list of manufacturer deals and sends you cash back any time you buy something for which there’s a posted deal.

17. Boxed

Boxed is an app and online service that combines most of the benefits of a warehouse store membership — BJ’s, Costco, Sam’s Club, etc. — with the convenience of home shopping. Signing up is free, and there is no membership fee — just free shipping in the lower 48 and wholesale prices for bulk amounts of groceries and household products.

18. OpenTable

Nothing is frugal about dining out in restaurants — but if you do it right, even infrequent visits could help you earn back a little something. OpenTable is an app that makes securing table reservations on a mobile device painless. However, you also earn points for each reservation and can cash out for affiliated restaurant gift cards or Amazon gift codes.

19. Capital One Shopping

This is a web app and browser extension but potentially significant results. It works exclusively with top retail stores like Amazon.com and provides historical overviews for the price of almost every item. If you want to uncover the best times to buy online from Amazon, Capital One Shopping is an indispensable tool.

20. Bank of America

As the name suggests, “B of A” is one of the biggest financial institutions in the country. And they’ve recently upped their game for savings and checking account holders by adding a “Keep the Change” feature to their account apps. This rounds up your purchases to a whole-dollar amount and saves these small amounts as deposits to your savings account.

21. Fidelity

Whether you have an employer-backed retirement account or a personal Roth IRA, there’s a good chance it’s serviced by Fidelity. Using the mobile and web app, it’s easy to watch your accounts grow or make additional one-time investments in your future as often as you can afford to do so.

22. Clarity Money

No matter the skill, sometimes we need some coaching — and saving money is no different. With this in mind, the Clarity Money app helps you find and cancel hidden recurring expenses like subscriptions and bad habits. It’ll also deliver insights — using a web or mobile app — about negotiating your costs lower and suggesting financial products that could help, based on your profile.

23. You Need a Budget

It’s got an on-the-nose name, but maybe straightforwardness is exactly what you want in a financial app. You Need a Budget has long been a favorite because it makes it easy to account for all of your spending, prioritize your expenses, understand basic and advanced budgeting techniques and save easily for unforeseen emergencies — or just a rainy day.

24. Your Regional Bank or Credit Union’s App

To close, let’s reflect on the fact that there’s often no better way to get a handle on your finances than to make them more accessible. To that end, find out if your regional credit union or bank has a mobile app. If they do, it means you can go everywhere with the means, in your pocket, to move money between accounts, check your balance or identify questionable transactions right when they happen. If saving money is the goal, then keeping your eyes on your money in the first place is step one.

Best Money Saving Apps Summary

The best money saving apps can really help you curb your overspending and help you automate your savings. It’s a win-win for your financial goals and your wallet. Money saving apps go hand in hand with financial independence apps, so go learn more in order to curb the alarming rate of millennial financial literacy.